In the intricate tapestry of Iran’s economic landscape, the Islamic Revolutionary Guard Corps (IRGC) stands out not just as a military entity but as a formidable economic force, whose reach extends into virtually every sector of the Iranian economy. This post aims to elucidate the pervasive influence of the IRGC in Iran’s economic domains, highlight its practices of money laundering, and emphasize the implications for global businesses involved, directly or indirectly, with entities linked to the IRGC.

The Economic Empire of the IRGC

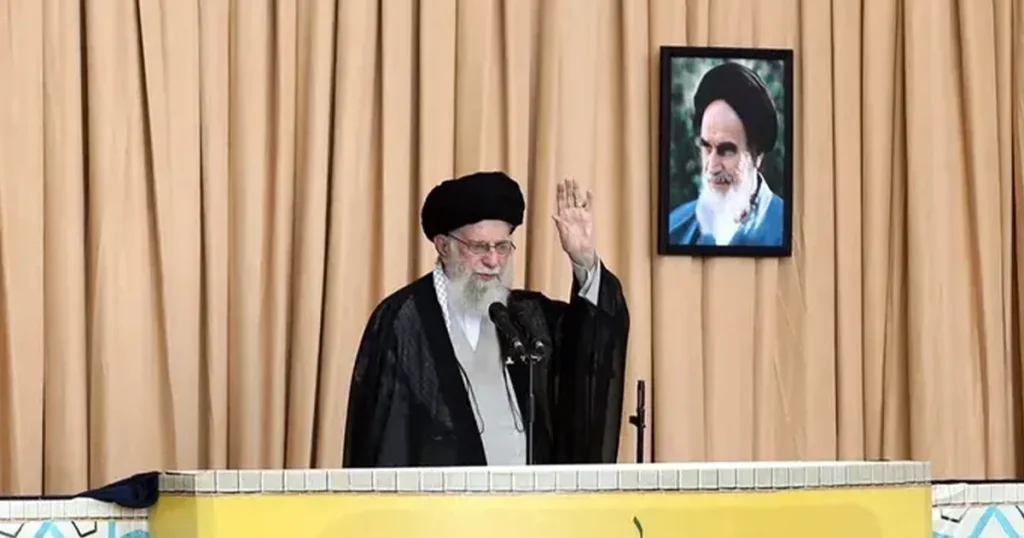

Founded in the aftermath of the 1979 Islamic Revolution, the IRGC initially served as a guardian of the revolution’s ideals. Over time, however, it metamorphosed into an economic juggernaut. The IRGC’s economic activities cover a vast spectrum, from construction and engineering, notably through its engineering arm, Khatam al-Anbia, to significant involvements in oil, gas, telecommunications, and even the automotive industry. These endeavors are not transparent ventures; rather, they are often cloaked under layers of companies and subsidiaries, making the full extent of their economic engagements hard to decipher.

Money Laundering and Shell Companies: The Western Connection

The involvement of the IRGC in money laundering operations and the use of shell companies have raised serious concerns on an international level. Reports suggest that the IRGC employs complex networks of shell companies and financial institutions, some of which extend into Western economies, to funnel money, evade sanctions, and finance its operations. These activities are not merely economic maneuvers but are intertwined with wider allegations of supporting extremist groups and contributing to regional destabilization.

The Moral and Legal Peril for Global Businesses

For businesses in the West and globally, the tentacles of the IRGC in Iran’s economy present a perilous landscape to navigate. Companies that engage, even inadvertently, with entities linked to the IRGC, may find themselves entangled in a web of moral and legal complications. Beyond the risk of breaching international sanctions, there’s a profound ethical dilemma. By doing business with these entities, companies could be seen as indirectly supporting the IRGC’s activities, which have been widely criticized for human rights abuses within Iran and aggressive actions in the region.

A Call for Diligence and Responsibility

In conclusion, the IRGC’s pervasive presence in Iran’s economy and its alleged involvement in dubious financial practices pose significant risks. For businesses operating on a global scale, it is imperative to conduct thorough due diligence to ensure that they do not become complicit, however unintentionally, in supporting activities that have far-reaching and detrimental human rights implications. This is not just a matter of legal compliance, but of moral responsibility. Ensuring that business operations do not support or finance the IRGC’s activities is a step towards distancing from potential complicity in acts that some consider as crimes against humanity. The message is clear: in the intricate dance of global economics and ethics, knowing your partner is not just good business sense; it’s a moral imperative.